The Tiny AI Play Targeting 200,000% Gains?

(No, It’s Not NVDA…)

Take a moment and imagine you were handed a time machine. You could travel back to 2004 and scoop up a stake in Facebook…back when Peter Thiel’s $500,000 investment valued the company at a mere $5 million. Fast forward: today, after rebranding to Meta, the company’s worth soared more than 200,000% from that initial seed valuation. That single pre-IPO bet turned into a life-changing windfall.

If you’re like most investors, you probably watched Facebook’s meteoric rise from the sidelines—maybe you got in after the IPO at $38 a share, or you simply stuck to “safe” names like Microsoft. Sure, those are solid companies. But let’s face it: the truly eye-popping gains usually happen before the big IPO party even starts.

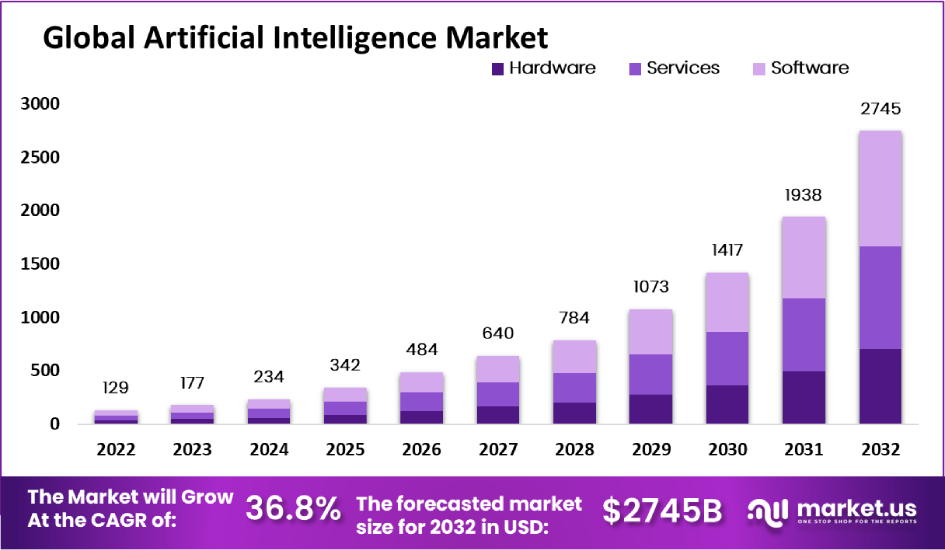

Now, AI is emerging as the transformational tech of the century. Names like Microsoft and NVIDIA have already skyrocketed this year, thanks to blockbuster deals and an industry-wide AI gold rush. But here’s the catch: are you really expecting NVDA to go up another 10x or 20x from here? Some analysts say their current valuations may already price in years of growth. If you’re seeking triple-digit or quadruple-digit returns, you might be looking in the wrong place.

That’s because companies today are staying private longer, “cooking” their valuations in massive private rounds while public investors miss the biggest leaps. Look at OpenAI—reports suggest they recently eyed a valuation of nearly $300B, all raised privately which means you’re not invited to the party. If you only invest after they go public—if they ever do—you’ve already missed that stratospheric growth.

Check out the recent DeepSeek shake-up (covered in multiple financial forums). While big-name AI companies got hammered by volatile market shifts, smaller, nimble AI startups quietly pivoted, adapted, and—most importantly—locked in early-stage funding rounds that gave their backers a shot at outsized returns. Being big can mean bloat and slower reaction time. Being small means fast, focused, and hungry.

- Big Tech Overvaluation? Huge market caps can stifle future growth potential.

- Small Cap, Big Moves? Smaller valuations allow for a much higher upside if the company executes—think potential 100x or even 1,000x returns if it becomes the next AI titan.

Bottom Line? If you’re not riding the pre-IPO wave, you’re potentially missing out on the biggest share of modern wealth creation. Public markets are still important—but more and more of the “explosive upside” is locked away in private deals, available only to those who invest early. And thanks to Reg CF, that can now be you.

Regulation Crowdfunding (Reg CF) is shattering old barriers. No longer do you need to be a “qualified investor” with a deep six-figure income or million-dollar net worth to own pre-IPO shares. For the first time, everyday investors can stake a claim before a company goes public—and potentially enjoy the largest slice of the upside.

If you had the chance to invest $10,000 in NVIDIA five years ago, you’d probably be smiling—NVIDIA’s done extremely well. But let’s be blunt: making a double or triple from here is great…but it’s not exactly a life-altering fortune. Contrast that with a nimble AI startup sitting at a tiny fraction of the valuation. If it pulls off a Facebook-like 200,000% jump over time? We’re talking millions in potential gains from a small investment. That’s the difference between “nice boost” and truly “life-altering returns.”

Our research team has combed through dozens of early-stage AI contenders. One small-cap, pre-IPO firm stands out for its breakthrough approach to generative algorithms—allowing it to develop, test, and deploy new AI models faster than many big names.

We’re keeping the details locked down—including the company name, ticker, and pitch deck—because we’ve learned that wide public disclosure can cause a surge in speculators that might inflate valuations prematurely. We don’t want this to turn into a hype bubble; we want serious, forward-looking partners.

We’ve put together a concise report detailing:

- Why this stealth AI player could be poised for exponential gains.

- The exact factors that differentiate pre-IPO powerhouses from overvalued behemoths.

- The behind-the-scenes insights gleaned from the DeepSeek meltdown and how it underscores the benefits of a nimble AI focus.

To access this exclusive report—and discover the name of the next potential AI unicorn—enter your email below. We’ll send you everything you need to evaluate the opportunity yourself, including risk factors and disclaimers.

Ready to learn how you can secure a pre-IPO stake in the revolutionary AI wave?

CLICK HERE and Enter Your Email

You’ll immediately receive:

- A deep-dive analysis of the stealth AI startup we believe has the potential for Facebook-level returns.

- Alerts on upcoming Reg CF deadlines (so you don’t miss your chance).

- Our proprietary checklist for vetting high-risk, high-reward AI investments.

Don’t wait—once the funding cap is reached, latecomers could be locked out. And if you keep sitting on the sidelines with only NVDA or MSFT in your portfolio, you might just watch the next generation of AI millionaires pass you by.

Pre-IPO investing can yield massive returns—but it’s also risky. Not all companies succeed. Some fail spectacularly. That’s exactly why we emphasize research, diversification, and never investing money you can’t afford to lose. Our report lays out the pros and cons so you can make an informed decision.

However, if you’re comfortable taking a calculated risk for the chance at truly life-altering gains, enter your email now and get immediate access to the full details on this stealth AI disruptor.

This information is confidential and only for subscribers.

Subscribe now for free and instantly receive information about this company.

Remember: This isn’t about charity. It’s about you capitalizing on a rare opportunity—before the mainstream market catches on.

Disclaimer

This is not investment advice. Past performance does not guarantee future results. All investing involves risk, including the loss of principal. Consult a licensed financial advisor for personalized recommendations. The hypothetical example of Facebook is strictly for illustrative purposes and does not reflect the outcome of every pre-IPO investment.